global@hmeonline.com

Mon to Fri 09:00 – 17:30

#1

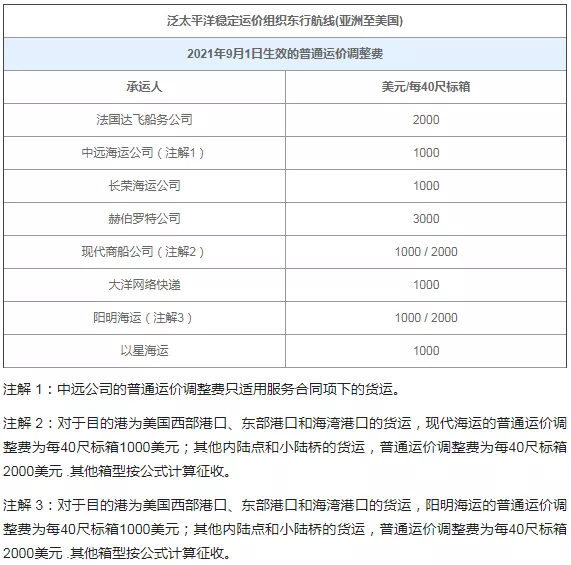

Some shipping companies have adjusted GRI since September 1st

Including CMA CGM, COSCO Shipping, Evergreen Shipping, Hapag-Lloyd, Hyundai Merchant Shipping, Ocean Express, Yangming Shipping and Yixing Shipping. The GRI, which took effect on September 1, 2021, is the 17th adjustment of East Asia/US routes since 2020.

#2

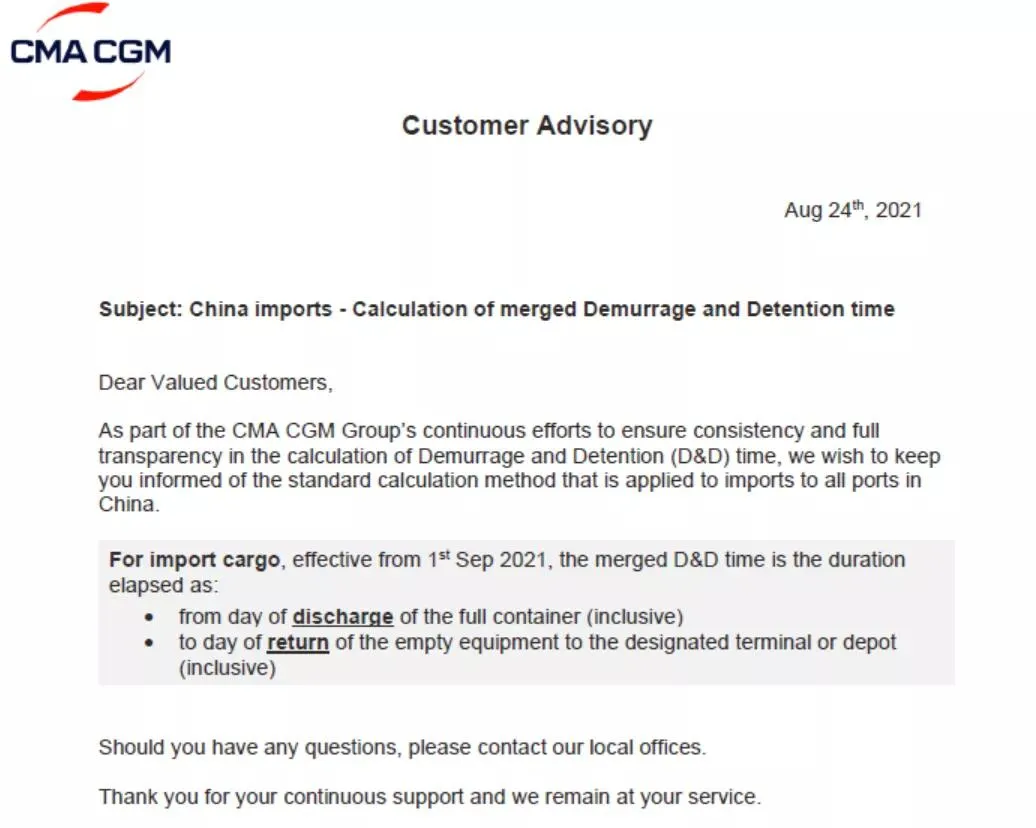

CMA CGM China demurrage fee calculation start time changes

CMA CGM China notified that for heavy containers unloaded from September 1st, the date of billing for DEMURRAGE and DETENTION has been changed from the original ship berth date to the actual date of unloading the container; the billing end date remains unchanged and remains empty The date when the container is returned to the shipowner's designated storage yard or dock.

#3

Customs conduct random inspections on 20 categories of illegally inspected commodities

On August 12, the General Administration of Customs issued Announcement No. 60 of 2021, deciding to conduct random inspections on some import and export commodities other than the statutory inspection commodities in 2021. The scope of the random inspections involves 20 categories of import and export commodities, of which 13 are imported commodities. , 7 categories of export commodities.

The scope of this adjustment focuses on random inspections involving safety, health, and environmental protection. There are many domestic and foreign consumer complaints, a large number of returned goods, large quality accidents, and import and export commodities with new special requirements at home and abroad.

1. Imported 13 categories of non-statutory commodities for random inspection

Dishwashers, air purifiers, electronic toilets, food waste disposers, induction cookers, printers, stationery, simulation accessories, car interior parts, clothing, helmets, child safety seats, plates, dishes, basins made of paper or cardboard , Cups and similar products.

2. The 7 types of non-statutory commodities exported by random inspection

Holiday string lights, LED lighting sources, children's bicycles, children's scooters, electric strollers, toys, plastic food contact products, etc.

Original announcement:

http://www.customs.gov.cn/customs/302249/302266/302267/3817175/index.html

#4

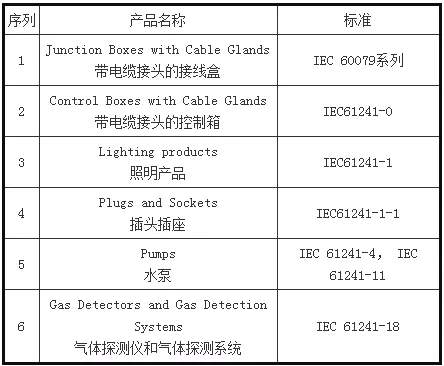

Saudi Arabia SIRC Regulation Update

The Saudi Bureau of Standards (SASO) issued an announcement on June 30, 2020. The following six types of products that were originally scheduled to implement SASO IECEE RC (SIRC) on July 1 will be postponed to September 1, 2021.

SASO issued an official announcement on August 6th. The following four types of products that were originally scheduled to implement SASO IECEE RC on September 1st will be postponed from November 1, 2021.

SASO issued an official announcement on August 6 to implement SASO IECEx (explosion-proof) certification for the following 6 types of products, which will be mandatory from November 1, 2021.

The Saudi Bureau of Standards SASO officially issued the RoHS regulations on July 9, 2021, and is scheduled to be enforced on January 05, 2022. This regulation applies to the following types of electrical and electronic equipment:

The Saudi Bureau of Standards SASO officially issued the RoHS regulations on July 9, 2021, and is scheduled to be enforced on January 05, 2022. This regulation applies to the following types of electrical and electronic equipment:

Large household appliances

Small household appliances;

Information technology and communication equipment;

lighting device;

Electrical and electronic tools;

Toys, leisure and sports equipment;

Monitoring and control equipment.

#5

Brazil lowers import taxes on video game products

Brazil announced a federal decree on August 11, 2021 to reduce industrial product taxes on game consoles, accessories and games (Imposto sobre Produtos Industrializados, referred to as IPI, industrial product taxes are required to be paid when importing and manufacturers/importers selling in Brazil) .

This measure aims to promote the development of Brazil's gaming and gaming industries.

This measure reduces the IPI of handheld game consoles and game consoles from 30% to 20%;

For game consoles and game parts that can be connected to a TV or screen, the tax reduction rate will be reduced from 22% to 12%;

For game consoles with built-in screens, regardless of whether they can be carried, the IPI tax rate has also been reduced from 6% to zero.

This is the third tax cut for the video game industry since the Brazilian President Bolsonaro took office. When he first took office, the above-mentioned product tax rates were 50%, 40% and 20% respectively. The Brazilian e-sports market has grown substantially in recent years. Well-known Brazilian teams have established their own e-sports teams, and the number of viewers watching live e-sports games has also greatly increased.

#6

China-Swiss certificate of origin format adjustment

According to the General Administration of Customs Announcement No. 49 of 2021, "Announcement on Adjusting the Format of the Certificate of Origin under the China-Switzerland Free Trade Agreement", China and Switzerland will use the new certificate of origin from September 1, 2021. The upper limit of the number of items to be included has been increased from 20 to 50, which will provide enterprises with greater convenience.

Original announcement:

http://www.customs.gov.cn/customs/302249/302266/302267/3744049/index.html

#7

Thailand and Hainan Province signed a mini free trade agreement

According to the Ministry of Commerce of Thailand, Minister Zhu Lin confirmed to host the signing ceremony of the Mini FTA between Thailand and my country’s Hainan Province on August 20. Officials believe that this will create more business opportunities for Thai companies, especially small and medium-sized enterprises, not only for traditional trade and investment, but also for extensive cooperation in cross-border e-commerce.

#8

Thailand levies value-added tax on electronic service platforms

Ainidi, Director of the Taxation Department of the Ministry of Finance of Thailand, revealed on August 22 that Thailand will start to levy an "electronic service value-added tax" on September 1 at an annual tax rate of 7%. The tax object is for foreign businesses that provide electronic service platforms in Thailand. By. At present, 18 foreign digital service platforms have registered with the VES electronic service value-added tax platform of the Department of Taxation. It is initially estimated that more than 100 businesses are eligible for taxation, which can increase tax revenue by about 1.8 million baht each year.

Ainidi pointed out that when the Tax Agency built an electronic service value-added tax system before the new crown pneumonia epidemic, it was estimated that the Thai government's treasury would realize 5 billion baht of VES tax annually. After the outbreak of the new crown pneumonia epidemic, the demand for electronic platform services has increased. It is necessary to incorporate the industry into the tax management system to become a taxation system that is unified with offline commerce and enhance the balance and steady development of e-commerce and traditional physical commerce. .

#9

Eurasian Economic Union imposes anti-dumping duties on Chinese aluminum kitchenware

On August 26, 2021, the Department of Internal Market Protection of the Eurasian Economic Commission issued Announcement No. 2021/288/AD32 in the official gazette. According to Resolution No. 107 on August 24, 2021, the Tableware (Russian: алюминиеваяпосуда) is subject to anti-dumping duties at a rate of 21.89%. The announcement will take effect 30 natural days from the date of issuance, and the validity period is 5 years. The tax codes of the Eurasian Economic Union of the products involved are 7615 10 100 0, 7615 10 800 9, 7616 99 100 8 and 7616 99 900 8.

#10

List of exhibition recovery in Europe, America and Middle East from September

With the increase in the rate of vaccine delivery, many countries around the world have restarted their economies, and one of the important ones is the recovery of the convention and exhibition industry. Important exhibitions in Europe, America and the Middle East are gradually restarting